travel nurse tax home reddit

Text them and get told to join their FB group. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes.

Travel Nurses Arriving For Crisis Pay R Nursing

They often have problems Taxes can be a mess depending on the states you work.

. You maintain living expenses at your place of permanent residence. Okay guys I know this has been done before but Ive noticed a lot of misinformation being given by new recruiters and others. You dont get to travel and see the country.

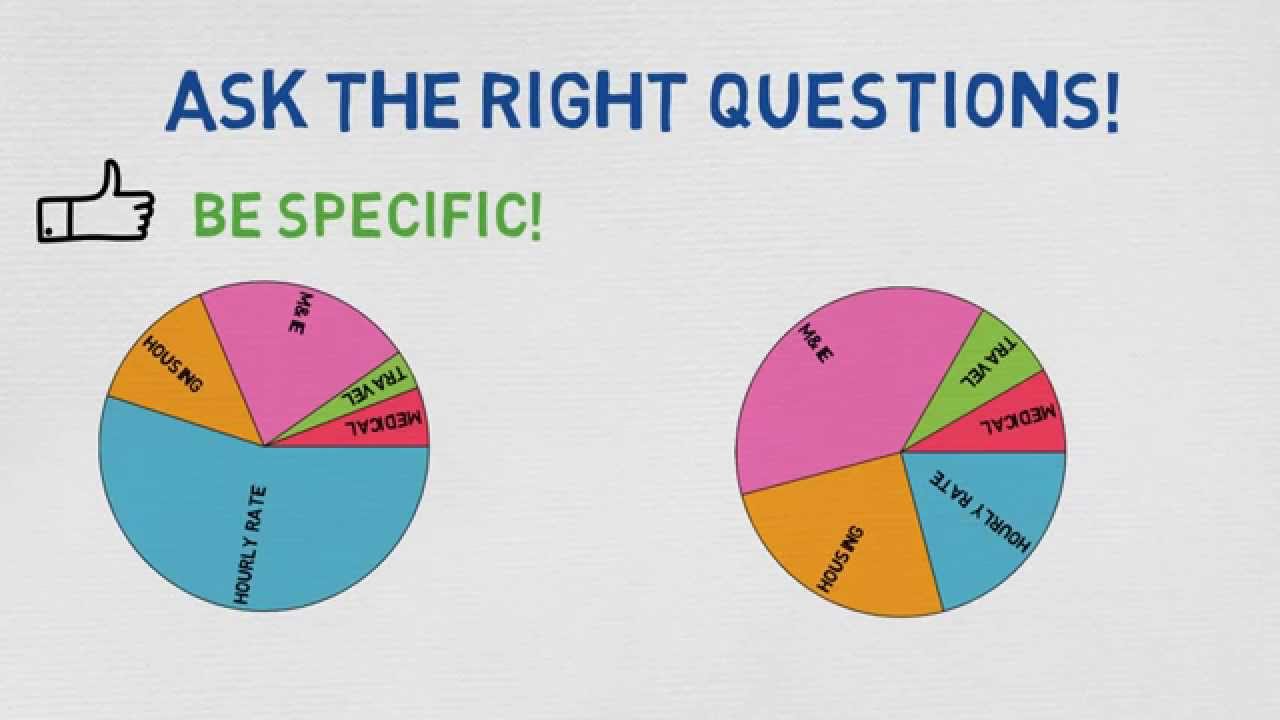

Can only find OLD job listings. Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. The contract typically quotes them as an hourly value.

For an obscure example. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. SnapNurse is literally the worst.

I only worked in one location as a traveler so my taxes still seem relatively uncomplicated since I have only my home state and one travel state. Causing you to pay for two places to live. You have not abandoned your tax home.

Take a look at this link. Travel to and from your tax home counts towards time worked. Its prominent among both travel nurses and travel nursing recruitersPurveyors of this rule claim that it allows travel nurses to accept tax-free reimbursements as long as the travel assignment is 50 miles or more from the travel nurses.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage. Builds a lot of new skills constantly.

During that time I get untaxed stipends for work to cover travelhousing expenses. Im a Travel Nurse AMA. Hospitals budget for that 13 weeks and re-evaluate the need for the added expense of a travel Nurse after the 13 weeks.

The complexity of a travel nurses income could look like a red flag to the IRS. If maintaining your tax home is too much work and you prefer to go from assignment to assignment without returning home do it. This is typically done in the form of an expense report.

Here is an example of a typical pay package. Theres often a reason these unitshospitals are short staffed. RNs can earn up to 2300 per week as a travel nurse.

The IRS requires that travel nurses satisfy three requirements to maintain a tax home and save on tax deductible expenses. For example if the lodging stipend MIE stipend and travel stipend have a combined value of 22 per hour then the penalty for missed-hours would be 22 per hour. When youre working as a travel therapist having a tax home allows you to take housing and per diem stipends provided by travel therapy companies without having to pay taxes on them due to the stipends being a reimbursement for costs incurred at the travel.

The disparity between your expenses and your income could look a little funny on paper so the bureau may want to double-check everything. For true travelers as defined above the tax rules allow an exception to the tax home definition. There are always technicalities on top of sound bites.

Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. Drastically narrows your opportunity of getting a travel contract. Rates are lowered after the initial contract is completed if thats where the market is- that is why theyre 13 weeks.

Thus working four consecutive 3 month assignments is actually greater than a year. 250 per week for meals and incidentals non-taxable. While higher earning potential in addition to tax advantages are a no.

You still need to set up housing. Establishing a Tax Home. First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends.

2You still work in the tax home area as well. Licensing can be a mess depending on the states you work. There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements.

I could take a travel assignment in my same hometown and still receive benefits but where a lot of travel nurses will end up keeping money is on stipends and stipends not being taxed. You work as a travel nurse in the area of your permanent residence and live there while youre working. The way it works is that I have a tax home and then work contracts for hospitals for a few months at a time.

Youre basically working a job but with a longer commute and temporarily living in two locations. It provides a lot of question in regards to traveling and taxes. Ive been a nurse ten years with intermittent travel experience due to being a military spouse.

Whats the fucking point in having. Yes you may lose 4000 to 6000 in tax savings a year but the cost and time of maintaining your tax home may exceed that amount. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly.

2You still work in the tax home area as well. The missed-hourscancelled shift penalties are typically equal to the value of all the stipends. 1The new job duplicates your living costs.

You lose the ability to work with different patient populations. Basically a tax home is your primary residence where you live andor work. 250 per week for meals and incidentals non-taxable.

Ive heavily researched travel nursing including the difficult tax parts of the job to make sure I dont get audited and I get the best experience possible. From what I am told from people who travel and still live with their parents is that as long as you pay them rent at market value that can be tracked down AND your parents puts that rent money as income for tax return it is full proof. Using someone elses address isnt a tax home.

Cant post asking to be directed to anything recent and have been told their FB group is the way to find a recruiterjob. This is due to elements such as your deductions or your seemingly low taxable wages. Dont live your life around a tax deduction.

20 per hour taxable base rate that is reported to the IRS. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Get to see many areas of the country.

Another reason you may face a travel. I apply to contract jobs on their travel jobs pagehear nothing for weeks. A bit technical and unlikely that a first line auditor would catch it in my belief anyway.

2000 a month for lodging non-taxable. Your tax home is your main place of living. For this to apply however the travel nurse must meet 2 out of 3 of the following criteria.

Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence. You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Cons of local travel nursing.

I assume that those who believe they dont have a tax-home are harboring this belief because. 500 for travel reimbursement non-taxable.

What Do Travel Nurses Need To Know About Taxes Mileiq

Shedevilbynight A Drama Disaster Megathread R Rupaulsdragrace

How Long Can A Travel Nurse Stay In One Place Bluepipes Blog

Trusted Guide To Travel Nurse Taxes Trusted Health

Travel Nursing Is Great But Don T Forget Your Tax Home R Nursing

Stds Woman Shares Her Experiences Of Being Slut Shamed By A Nurse Indy100 Indy100

How Much Does Travel Nursing Pay Marvel Medical Staffing

I M A Travel Nurse Ama R Nursing

Maintaining A Tax Home Has Been A Hot Topic Among Travel Nurses For Quite Some Time Some Claim T Emergency Nursing Nurse Inspiration Nurse Practitioner School

Van Is Done And I Start My Full Time Van Life On Friday Travel Nursing Here I Come R Vandwellers

Trusted Guide To Travel Nurse Taxes Trusted Health

Rates Were Cut For All Travel Nurses This Week By Banner So They All Quit This Week This Shows That Right Decision Was Made Banner Management Is The Worst R Nursing

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurses Can Make More Than Attendings R Medicalschool

What Travel Nurses Ought To Know About The Cost Adjusted Value Of Their Pay Bluepipes Blog

6 Things Travel Nurses Should Know About Gsa Rates

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses